What’s ahead in our property markets in the next year or two?

What's the outlook for the Australian property markets for 2023 and beyond?

Key takeaways

Despite 9 interest rate rises (for now) Australia's property markets have been remarkably resilient.

The current interest rate hiking cycle has triggered the largest and fastest decline in Australian property values since CoreLogic started recording data in the 1980s.

The peak-to-trough combined capital cities drop of 8.6% (from May 2022 to January 2023) followed a significant 26% uplift in value between September 2020 and April 2022.

However, some markets have defined the downward trend. While Sydney and Melbourne have born, the brunt of price falls, are the capital cities have been largely spared.

Lower listing volumes (fewer properties for sale) are helping protect the market from further downward pressure.

While many are concerned about a "fixed rate cliff" ahead, RBA data indicates the majority of mortgage debt is on variable terms. Many people have also been overpaying on their mortgages during the low interest rate cycle.There may be more rate hikes ahead, but our analysis suggests there could be light at the end of the tunnel as the decline in property price falls is slowing down, asking prices are holding steady or increasing and auction clearance rates are solid.

Once interest-rates peak (and that may not be that far off), and once inflation peaks (and that's probably already happened) consumer confidence will return, and the market will reset as a new property cycle begins.

But don't expect a rapid recovery - the next stage of the cycle is the stabilisation phase.

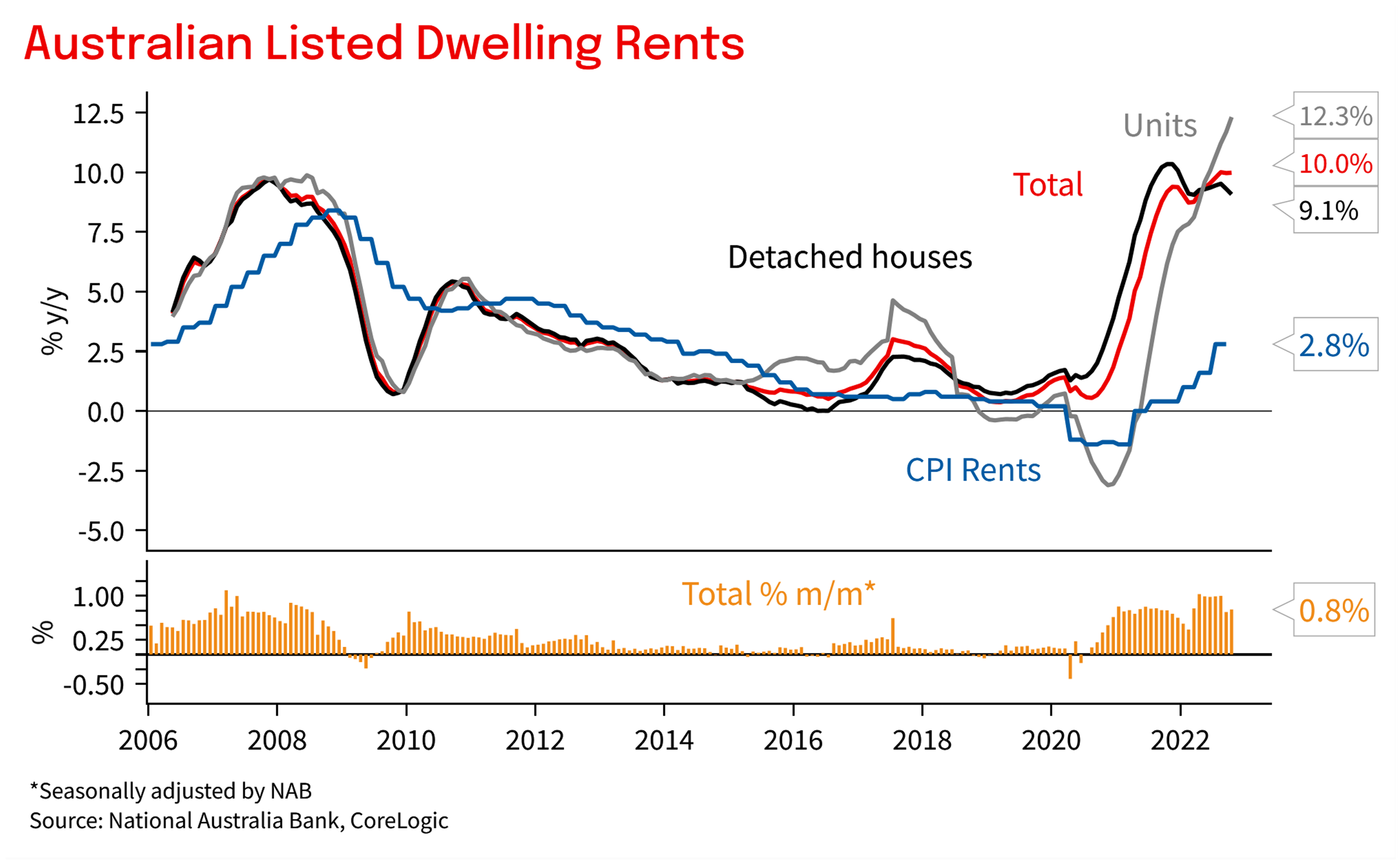

There is no end in sight for our rental crisis and rents will continue skyrocketing this year.

What’s ahead in our property markets in the next year or two?

This is a common question people are asking now that the housing markets have transitioned from the once-in-a-generation property boom experienced in 2020 -21 to the adjustment phase of the property cycle that could be best described as multi-speed.

After peaking in May 2022 CoreLogic’s national Home Value Index fell -5.3% over the 2022 calendar year, and while overall the Australian property market is in a downturn, not all of the nation’s property markets are being impacted equally.

Each State is at its own stage of the property cycle and within each capital city there are multiple markets with property values falling in some locations, and stagnant in others and there are still locations where housing values are still rising.

The upper quartile of the housing market, particularly in Sydney and Melbourne, led the downturn through 2022, with most capital city and broad ‘rest-of-state’ regions recording weaker performance across the upper quartile relative to the lower quartile and broad middle of the market.

That's not unusual...the more expensive end of the market tends to lead the cycles, both through the upswing and the downturn

After recording significantly stronger appreciation through the upswing, the fall in regional dwelling values is catching up with the capital cities.

Importantly, recent months have seen some cities recording less of a performance gap between the broad value-based cohorts.

Sydney is a good example, where upper quartile house values actually fell at a slower pace than values across the lower quartile and broad middle of the market through the final quarter of the year.

What's currently happening to property values in Australia

The following table shows what happened to dwelling prices around Australia since their peak.

As you can see while values in our capital cities grew considerably, the regional property market performed even better during the last property boom.

But now we're in the adjustment phase of the property cycle and overall property values are 8% lower than their peak.

That's not a property market crash - is it?

It's an orderly correction that had to occur after house prices all around Australia got ahead of themselves.

At the same time we're experiencing a rental crisis with historically low vacancy rate and rising rents.

Here's how the Australian property market is coping with rising interest rates.

Despite 9 interest rate rises (for now) Australia's property markets have been remarkably resilient.

The current cash rate hiking cycle has triggered the largest and fastest decline in Australian property values since CoreLogic started recording data in the 1980s.

The peak-to-trough combined capital cities drop of 8.6% (from May 2022 to January 2023) followed a significant 26% uplift in value between September 2020 and April 2022.

However, some markets have defined the downward trend. While Sydney and Melbourne have born, the brunt of price falls, are the capital cities have been largely spared.

Lower listing volumes (fewer properties for sale) are helping protect the market from further downward pressure.

While many are concerned about a "fixed rate cliff" ahead, RBA data indicates the majority of mortgage debt is on variable terms. Many people have also been overpaying on their mortgages during the low interest rate cycle.

There may be more rate hikes ahead, but our analysis suggests there could be light at the end of the tunnel as the decline in property price falls is slowing down, asking prices are holding steady or increasing and auction clearance rates are solid.

Once interest-rates peak (and that may not be that far off), and once inflation peaks (and that's probably already happened) consumer confidence will return and the market will reset as a new property cycle begins.

But don't expect a rapid recovery - the next stage of the cycle is the stabilisation phase.

There is no end in sight for our rental crisis and rents will continue skyrocketing this year.

Australian housing market predictions

Now I know some potential buyers are asking:

Well, now that the boom is over will the property market crash in 2023?

They have obviously been listening to those perma-bears who keep telling anyone who's prepared to listen that the property markets are going to crash, but they've made the same predictions year after year and have been wrong in the past and will be wrong again this time.

You've probably also read those forecasts - you know...that property values will fall 20 to 25%.

In fact... Property Prices Will Fall 30% was a recent headline in the Australian Financial Review by a respected columnist, and here he was not talking about a specific segment of the market, but about "the Australian property market”.

And he's probably not taking much "joye" in seeing how resilient our housing market is

Fact is.... a fall of this magnitude has never happened before.Not during the recession of the 1990s, not during the global financial crisis and not during the period of a credit squeeze in 2017-18.

The worst slump in the overall Australian property market was after the credit squeeze on 2016-17 and when there were concerns around proposed changes to negative gearing before the 2019 election.

And at that time the peak to trough drop between December 2017 and June 2019 was 9.9%.

And considering the current state of the economy, our financial health and property markets there's no credible reason to suggest a fall of this magnitude should happen now.

Sure we're experiencing a housing market correction - it started at the beginning of the year in Sydney and Melbourne - and is now working it's way across the nation, but there will be no property market crash.

But as you can see, from the following chart, over the years, a property booms have been large in the following downturns have been small, in proportion to the previous rise in prices.

Source: Domain

Sure interest rates are rising, but they're only one of the many factors that affect home prices.

For a property market to "crash" there must be a large number of forced sellers and nobody on the other side of the transaction to purchase their properties meaning they have to give away their properties at very significant discounts.

Remember home sellers are also homebuyers – they have to live somewhere and the only reason they would be forced to sell and give up their home would be if they were not able to keep up their mortgage payments.

This happens when:

Unemployed levels are high - today anybody who wants a job can get a job.

Mortgage costs (interest rates) zoom up - despite rising interest rates, they are only like you to get to where they were before the pandemic a couple of years ago and borrowers could cope then.

Sure, what happens next to our property market will be partly shaped by the speed and extent of further interest rate tightenings, but as you will read below there are still many positive factors underpinning our housing markets which means that the property crash which the Property Pessimists are predicting is unlikely to occur.

And we know from recent history that neither the banks, our governments or the RBA want to see a housing market crash and they'd rather support mortgage holders than take over their homes.

The total value of Australia’s residential property market is now worth $9.7 trillion after growing at the fastest annual pace on record in 2021.

Residential property prices rose 23.7% through 2021, meaning that the collective value of the wealth of property owners increased by $2 trillion in just one year alone!

And even though many homeowners and property investors took on more debt, the total of all the loans outstanding against all the residential real estate in Australia is $2.1 trillion - in other the "overall" Australian housing market has a very low (23%) Loan to Value ratio.

Population forecasts

Australia’s population growth is projected to return to around 355,000 by 2024/25, before easing to around 330,000 per annum by 2032 in line with the reduction in the natural increase.

Quantify Strategic Insights have released population forecasts for the next ten years by age cohort as shown in the chart below.

The rate of population growth will fluctuate over the next decade and be driven by three cohorts,

baby boomers (born 1946-1964: aged 58 - 76 years old),

millennials (born 1981-1996: 26 - 41 years old) and

baby bonus generation (lagged Gen Z: born 2006 - 2021)

And we're just not going to build enough dwellings...

New data from the Australian Bureau of Statistic (ABS) shows approvals fell by 9 percent in November 2022, with the level now around 15 percent lower than 12 months ago (its lowest since June 2020, excluding January, which was artificially lowered by the impact of the initial Omicron wave).

RBA economic forecasts

In its November Statement of Monetary policy the RBA has revised up its forecasts for inflation and unemployment, and revised lower its forecasts for Australia’s economic growth.

The RBA sees inflation peaking at 8.0% in the fourth quarter of 2022 (up from its previous forecast of 7.8%) before slowing to 4.7% over 2023 and 3.2% over 2024.

The RBA doesn't seem to my mind that it will take inflation sometime to fall to within its desired range of 2 to 3%, suggesting that it is not going to aggressively raise interest rates like some overseas central banks are.

The RBA has left its options open, saying that:

"The size and timing of future interest rate increases will continue to be determined by the incoming data and the Board’s assessment of the outlook for inflation and the labour market."

Just how high the cash rate will go remains a contentious issue.

The Reserve Bank of Australia (RBA) started hiking the official interest rate in May and has delivered consecutive double-whammy hikes since June, however the last 2 interest rate rises have been 0.25%.

However, interest rates will likely continue to rise one or two more times to subdue inflation, with the core measure the RBA watches most closely expected to peak at 6.5% by December.

Reflecting its slower economic growth forecast, the RBA has upgraded its unemployment forecast, now expecting unemployment to creep up to 4.5%.

Note: RBA boss tips 10% house price falls!

Speaking in front of a parliamentary committee in Canberra Reserve Bank governor Philip Lowe says he wouldn’t be surprised if house prices came down by 10 per cent as higher interest rates bite.

Now that's nowhere near as dire a prediction as made by those perpetual property pessimists and much more realistic in my opinion.

In fact we're almost there now!

Dr Lowe says the RBA does not explicitly forecast house prices, and he noted that home values went up 25 per cent over the past two years: which he said was “A very, very big increase”.

“It would not surprise me – and this is not a forecast – but it would not surprise me if prices came down by a cumulative 10 per cent.

And even if they did that, they're still up 15 per cent over three years.

We don't want to forecast housing prices because it's very, very difficult to do, but as interest rates rise further, and they will rise further, I'd expect more heat to come out of the housing market and prices to come down further."

Dr Lowe said that the Reserve Bank is not to blame for Australia's housing affordability issues ...

“The fact that Australians have to pay high prices for housing isn’t about (interest rates) over a long period of time.

It's the choices we’ve made as a society that have given us high housing prices,” Dr Lowe says.

“And the high housing prices come not from the high cost of construction, they come from the high cost of land embedded in each of our dwellings,” he says.

“And why do we have a high cost of land? Because of the choices we have made about taxation, the choices we’ve made about zoning and urban design.

“The fact that most of us have chosen to live in fantastic cities on the coast.

And that we want a block of land.

We don’t want to live in high density, and we’ve chosen as a society to underinvest in transport.

“So all of those things have either reduced the supply of well located land, and so we have high land prices embedded which gives us high housing prices. Interest rates have influenced the cycle, but not structurally.”

So how much further will interest rates rise?

Economists at Australia's big 4 banks are mixed in their outlook following the RBA's most recent interest rate rise:

CBA predicts a peak cash rate of 3.1% - in other words no more interest rate rises

NAB believes rates will rise to 3.6% - they are expecting 2 more interest rate rises

Both Westpac and ANZ believe rates will peak at 3.85% - they're expecting 3 more interest rate rises this year.

What about mortgage stress?

Recent RBA modelling shows that overall the majority of variable rate mortgage households are likely to be well placed to manage higher minimum loan repayments should the RBA cash rate rise by another 1% to 3.60%.

The analysis suggests households should be able to weather an RBA cash rate of 3.6% without raising any financial stability concerns.

Whether the cash rate needs to get to that level will of course depend on the outlook for inflation and how households respond to higher rates – to what degree do they draw down on accumulated savings buffers and/or reduce real consumption.

Households will meet higher minimum mortgage repayments by drawing down on savings buffers, or paring back on real non-essential consumption.

95% of owner-occupier variable rate borrowers will still face a reduction in free cash flow, with such reductions being large for around 50% of borrowers.

On the upside it is clear that around half of variable rate owner-occupier households have large buffers - 55% would not exhaust buffers for at least two years even with higher minimum repayments if they chose to maintain non-essential spending.

On the downside, 30% would exhaust buffers with higher minimum repayments within six months if they maintained non-essential spending at current levels.

I know the media is full of stories about mortgage stress leading the regular band of ‘negative nellies’ to say this will lead to forced sales and drive down our property market.

However, I believe this is unlikely for a number of reasons:

Interest rates will only end up a little higher than they were prior to the pandemic and we weren't troubled by mortgage stress then.

The banks have been conservative and anyone who borrowed in the last few years had the serviceability checked based on the presumption that it would rise at least 2.5% if not 3%.

Aussies have built up a significant war chest of savings in their offset accounts and more than half of mortgage holders have paid their mortgage many months in advance.

Half of the Australian homeowners have no debt at all, while most people who bought a property in the last couple of years already have significant equity, investors are getting higher rent while homeowners are getting higher wages.

Our economy is growing strongly and anyone who wants a job can get a job – inflation and high-interest rates are a concern when unemployment creeps up and people can't pay their mortgages, but that's not the case at present.

The Australian residential real estate market is too big to fail - neither the banks want property values to drop – it's not really in their interest.

I've already explained the RBA's modelling in October 2022 which showed that most Aussie households should be able to weather an RBA cash rate of 3.6% without raising any financial stability concerns.

Dr Andrew Wilson's property market forecasts

Dr Andrew Wilson reported that all capitals, with the exception of Sydney, reported marginally higher asking prices for established houses listed for sale over November compared to the previous month.

On the other hand, asking prices for established units listed for sale produced mainly positive results over the month of November.

Another indication that market sentiment is changing is rising auction clearance rates which are a good in time indicator of buyers and seller sentiment.

Dr. Wilson believes our housing markets are looking for a floor and will turn during this year.

Negative influences on our property markets

Sure, our housing markets are facing some headwinds, including:

Consumer confidence has taken a significant hit and that's affecting our housing markets with buyers being more cautious and many taking a wait-and-see approach, while sellers’ confidence is more fragile.

Fear of rising inflation and cost of living pressures is sidelining many buyers

Rising interest rates are reducing borrowing capacity

Uncertainty about our economic future with all the talk of a recession overseas, ongoing geopolitical problems, the share market falling is dampening buyer and seller confidence

Affordability issues will constrain many buyers: The impetus of low-interest rates allowing borrowers to pay more has worked its way through the system.

Now, with property values being 20- 30% higher than at the beginning of this cycle - and at a time when wages growth has been moderate at best and minimal in real terms for most Australians - this means that the average home buyer won’t have more money in their pocket to pay more for their home.The pent-up demand is waning: While many buyers delayed their home-buying plans over the last few years because of Covid, a significant volume already made their move. There are only so many buyers and sellers out there, so we can expect there will be fewer looking to buy in 2022.

FOMO (Fear of Missing Out) has disappeared: Buyers are being more cautious and taking their time to make decisions. This is in stark contrast to last year when many took shortcuts to enter the market.

On the other hand there are still...

Strong fundamentals underpinning our housing markets

These include:

There is a shortage of good properties for sale and virtually no properties to rent

International immigration is picking up and this will increase the demand for housing.

There is little new construction in the pipeline – we’re just not building enough dwellings and increasing construction costs at a time of a shortage of labour means the end value of new projects will need to be up to 20% higher to make projects financially viable for developers.

Our economy is still growing and Unemployment is at historically low levels meaning anyone who wants a job can get a job (so they'll be able to pay the mortgage repayments.)

Wages are starting to grow

Household balance sheets are strong - we have a ‘natural buffer’ with $250- $260 billion in aggregate savings nationally, much of it in offset accounts.

Many borrowers are ahead in their mortgage payments - Matt Comyn, chief executive of Commonwealth Bank recently said that three-quarters of their loans are approximately two years ahead on repayments.

We have a strong banking system that has been strict in its lending criteria, meaning there are very few non-performing loans.

There are still Government incentives to encourage first-home buyers into the market.

What's ahead for our property markets in 2023?

The last few years have shown us how hard it is to forecast property trends… but here goes - I'm going to share a number of property predictions for the balance of 2022 and beyond.

1. 2023 will be a year the property market resets, and a new cycle begins

I see 2023 calendar year as year of two halves.

There will be further falls in home values through the early months, followed by a stabilisation in housing prices after interest rates find a peak.

However, a broad-based rise in housing values would be dependent on interest rates coming down, or on other forms of stimulus.

But wait, there's more

A fall in new listings - new properties coming onto the market for sale have taken some pressure out of the market, while there has been a shift and rotation in spending from goods back to services on top of a decline in consumer and home buyer confidence thanks to concern about rising rates, inflation and the future of property values.

2. There are still lots of people interested in buying property

While many factors affect property values, the main drivers of property price growth are consumer confidence, availability of credit, low-interest rates, economic growth and a favourable supply and demand ratio.

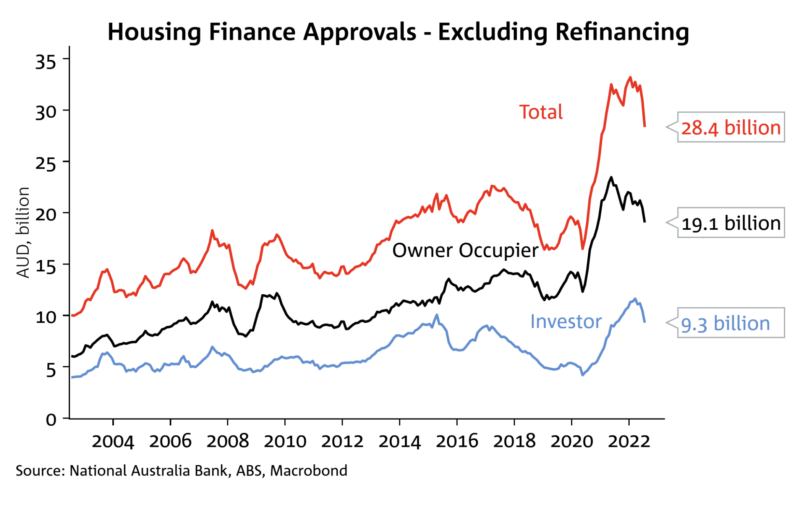

The following chart shows that home buyers and investors are still obtaining finance approvals and this means they intend to buy property.

As you can see the latest figures show over $28 billion of finance was approved last month meaning their new buyers in the market with a budget of over $30 billion.

As I said, we’re in the downturn phase of the property cycle, and sure, the value of many properties will decrease in the coming month - but that will only be in the short term.

There are still some strong patches in our property markets where A-grade homes and investment-grade properties are still selling well.

It’s a bit like having one hand in a bucket of hot water and another hand in a bucket of cold water and saying “on average I feel comfortable”.

However strategic investors are not phased by this stage of the cycle, they understand real estate is a long-term game and they’re more focussed on the long-term rise in values rather than short-term slumps.

It's likely prices will keep falling a little as the RBA continues its rapid tightening cycle in order to quell the rise in inflation.

While fixed rates have already risen sharply, the steep increases in the cash rate is now flowing through to variable mortgage rates, lifting minimum repayments significantly and reducing borrowing power.

On the other hand, the return of immigration, falling unemployment and rising wages as well as rising exports and a strong economy will be supportive factors.

3. Our property markets will be fragmented

The recent property boom was very unusual.

All types of properties in almost any location around the country increased in value substantially.

Moving forward our property market will be much more fragmented.

But there was really never one Sydney property market or one Melbourne property market.

There are markets within markets – there are houses, apartments, townhouses and villa units located in the outer suburbs, middle ring suburbs, inner suburbs and the CBD.

And they're all behaving differently.

If you think about it, certain demographic segments will find the rising cost of living due to inflation and higher rents or higher mortgage costs at a time when wages are not keeping up with inflation will either stop them getting into the property markets or severely restrict their borrowing capacity.

This will impact negatively on the lower end of the property markets which will also be affected by the fact that many first home buyers borrowed to their full capacity and will have difficulty keeping up their mortgage payments up at the time of rising interest rates or when their fixed rate loans convert to variable rates.

In other words, there will be little impetus for capital growth at the lower end of the property market

That's why I would only invest in areas where the locals’ income is growing faster than the national average.

These tend to be the "established money" areas or gentrifying suburbs.

Think about it… in these locations, locals will have higher disposable incomes and be able to and are likely to be prepared to pay a premium to live in these locations.

Many of these locations are the inner and middle-ring suburbs of our capital cities which are gentrifying as these wealthier cohorts move in.

There are great investment opportunities in these suburbs in houses and townhouses.

4. Property demand from home buyers will continue

Last year when home prices surged around Australia the media kept reminding us we were in a property boom.

The result was that emotions ran high and FOMO was a common theme around Australia’s property markets.

Now that overall growth in our property markets has slowed as we discussed above buyers are becoming more selective.

Yet there are still more buyers in the market for A-grade homes and investment-grade properties than there are properties for sale and this will underpin the values of this type of property moving forward.

Sure some of the discretionary buyers are now out of the market, but people are still getting married, others are getting divorced and some are having babies and they usually require new homes, so our property markets are going to keep on keeping on.

5. Investors will keep entering the property market

And they’ll squeeze out first-home buyers.

As rents rise and the share of first-home buyers drops, strategic investors with a realistic long-term focus will return to the market.

While there were many first-time buyers (FHBs) in the market in 2021, buoyed by the many incentives being offered to them, now demand from FHBs is fading as property investors re-enter the market.

Of course over the last few years, investor lending has been low, but with historically low-interest rates and easing lending restrictions, investors are back with a vengeance.

In the last month investor loan approvals fell a little, but a total of $9.3 billion of new loans were approved to investors last month.

6. Neighbourhoods will become more important and people will pay a premium to be in the right neighbourhood

If Coronavirus taught us anything, it was the importance of living in the right type of property in the right neighbourhood.

Now that we have emerged from our Covid cocoons there is a flight to quality properties and an increased emphasis on liveability.

As their priorities change, some buyers will be willing to pay a little more for properties with “pandemic appeal” and a little more space and security, but it won’t be just the property itself that will need to meet these newly evolved needs – a “liveable” location will play a big part too.

In our new “Covid Normal” world, people will pay a premium for the ability to work, live and play within a 20-minute drive, bike ride or walk from home.

They will look for things such as shopping, business services, education, community facilities, recreational and sporting resources, and some jobs all within 20-minutes' reach.

Residents of these neighbourhoods have now come to appreciate the ability to be out and about on the street socialising, supporting local businesses, being involved with local schools, and enjoying local parks.

Many inner suburbs of Australia’s capital cities and parts of their middle suburbs already meet the 20-minute neighbourhood tests, but very few outer suburbs do because there is a lower developmental density, less diversity in its community, and less access to public transport.

And ‘neighbourhood’ is important for property investors too, and here’s why.

In short, it’s all to do with capital growth, and we all know capital growth is critical for investment success, or just to create more stored wealth in the value of your home.

Sure, there is always the opportunity to add value through renovating your property or making a quick buck when buying well.

But these are one-offs and won’t make a long-term difference if your property is not in the right location, because you can’t change or upgrade the location.

This is key because we know that 80% of a property’s performance is dependent on the location and its neighbourhood.

In fact, some locations have even outperformed others by 50-100% over the past decade.

And it’s likely that moving forward, thanks to the current environment, people will place a greater emphasis on neighbourhood and inner and middle-ring suburbs where more affluent occupants and tenants will be living.

These ‘liveable’ neighbourhoods with close amenities are where capital growth will outperform.

How do we identify these locations?

What makes some locations more desirable than others?

A lot has to do with the demographics – locations that are gentrifying and also locations that are lifestyle locations and destination locations that aspirational and affluent people want to live in will outperform.

It's well known that the rich do not like to travel and they are prepared to and can afford to pay for the privilege of living in lifestyle suburbs and locations with a high walk score – meaning they have easy access to everything they need.

So lifestyle and destination suburbs where there is a wide range of amenities within a 20-minute walk or drive are likely to outperform in the future.

Hence why, as discussed above, these areas will fetch a premium.

At the same time, many of these suburbs will be undergoing gentrification - these will be suburbs where incomes are growing, which therefore increases people’s ability to afford, and pay higher prices, for the property.

7. Rent prices will increase strongly

Australia is experiencing a rental crisis and our rental markets are set to remain tight in 2023.

Increased rental demand at a time of very low vacancy rates will see rentals continue to rise throughout the next few years.

Then as our international borders open further this will further increase the demand for rental housing.

If you think about it...when people initially move to a country or region, most rent first.

In addition, when foreign students return we'll see increased pressure on apartment rents close to education facilities and in our CBDs.

The table above from SQM Research shows that they're only around 33,000 vacant properties in Australia – we are the 200,000 new immigrants going to live?

And as rising house rentals will create affordability issues for many tenants, apartment rentals will also increase in 2022

8. Migration will resume

Freed from the constraints of needing to travel to a CBD office each day, and sick and tired of being locked down in our southern states, many Aussies migrated northwards to south-east Queensland last year.

And now that Australia’s internal borders have opened up it's likely that the northern migration will continue into 2022 driven by Queensland’s more affordable housing and perceived lifestyle benefits.

This, in addition to employment growth, long-term benefits of hosting the Olympics and the extra infrastructure building, means this part of Australia is looking particularly positive.

Not only this but overseas migration has also resumed, putting extra pressure on our housing markets, particularly in inner-city areas and near student campuses.

And recently Prime Minister Anthony Albanese has increased the quota for new skilled migrants to Australia.

9. The property cycle will be dominated by upgraders

The current property and economic environment, plus the scars left on many of us after a year or two of Covid-related lockdowns, have meant that Aussies are looking to upgrade their lifestyle, and this is something we’re going to see even more of in the coming years.

In fact, there are four key types of ‘upgraders’ we’re likely to see more from during this property cycle.

Tenants upgrading to better rentals - Many tenants are no longer happy to live in small dingy apartments and with an oversupply of rental units available in many areas, they are taking the opportunity to upgrade their accommodation. Other tenants who have managed to save a deposit are taking advantage of many of the many incentives available and are becoming first home buyers.

Homeowners upgrading to larger, better, homes - With interest rates still relatively low many existing homeowners are upgrading their accommodation to larger homes in better neighbourhoods. In fact, a recent survey suggested that one in three homeowners are looking to sell their homes in the next 5 years.

Homeowners looking for a sea- or tree-change - While small group homeowners are upgrading their lifestyle and moving out of the big smoke to regional Australia, more Aussies are looking to upgrade their lifestyle by moving to a better neighbourhood.As mentioned above, they love the thought that most of the things needed for a good life are just around the corner.

Baby boomers downgrading - Many Baby Boomers are looking to upgrade their accommodation by moving out of their old, tired family homes into large family-friendly apartments or townhouses. But they’re not looking for a sea change or tree change, they’re keen to live in “20-minute” neighbourhoods close to their family and friends.

10. Our economy and employment will remain robust

Sure the RBA wants to slow down our spending a little to bring down inflation, but despite this our economy will keep growing (albeit a little slower) and the unemployment rate will remain low as many new jobs will be created as our economy grows.

So how long will this downturn cycle continue?

Currently I see a window of opportunity for property investors with a long-term focus.

This window of opportunity is not because properties are cheap, however, when you look back into three years' time the price you would pay for the property today will definitely look cheap.

The opportunity arises because consumer confidence is low and many prospective homebuyers and investors are sitting on the sidelines.

However, I believe later this year or early next year as many prospective buyers will realise that interest rates are near their peak, inflation will have peaked and the RBA's efforts will bring it under control.

And at that time pent-up demand will be released as greed (FOMO) overtakes fear (FOBE - Fear of buying early), as it always does as the property cycle moves on.

We saw an opportunity like this in late 2018 - early 2019 when fear of the upcoming Federal election stopped buyers from entering the market. And look what's happened to property prices since then.

I saw similar opportunities at the end of the Global Financial Crisis and in 2002 after the tech wreck. History has a way of repeating itself.

You see...consumer sentiment shifts play a big role in the world of property.

When consumer sentiment is low as it currently is, this shows up in various metrics including:

Rising days on market (how long it takes to sell a property.

Property sales volumes reducing.

Vendor discounting increasing to meet the market.

Auction clearance rates falling.

Prices at the premium end of the property market fall first.

But as consumer sentiment picks up, and it will once people realise inflation has peaked and the RBA doesn't need to increase interest rates further, and that's likely to be in the first or second quarter of 2023, we'll see a shift in the metrics.

Buyers will feel more confident and re-enter the market.

Property prices will stop falling.

More vendors will feel comfortable putting their properties up for sale.

Prices will stabilise for a while and then slowly pick up.

The media will start telling good news stories, rather than trying to scare us about real estate Armageddon.

Poor consumer sentiment when most other economic fundamentals are strong simply means it's a cloud covering the sun.

Spring will follow Winter, and Summer will follow Spring - this too shall pass by and the long-term upward trend of the value of well-located properties will continue.

So my recommendation is that if you're in a financially sound position, buy while others are sitting on the sidelines.

While it may feel strange and counterintuitive to buy in a correcting market, there are many valid reasons why this is the best time to buy….and history has shown this to be correct over and over again.

There is less competition at present.

You have more time to conduct your due diligence and research.

It's a buyer's market that gives you the upper hand in negotiations.

But don't try and time the market - this is just too difficult.

And don't look for a bargain - A-grade homes and investment-grade properties are in short supply and still selling for reasonably good prices.

These high-quality properties will tend to hold their value far better than B and C-grade properties located in inferior positions and inferior suburbs.

And don't worry too much...

While a lot has been said about the +20% increase in property values many locations have enjoyed prior to this downturn, it must be remembered that the last peak for our property markets was in 2017 and in many locations housing prices remain stagnant over a subsequent couple of years which means that average price growth was unexceptional over the long term, averaging out at around 5 per cent per annum over the last 5 years.

Now I know some people are worried and wondering: "Are the Australian property markets going to crash in 2022 0r 2023?"

They hear the perpetual property pessimists who've been chasing headlines and telling everyone who's prepared to listen that the Australian property markets are going to crash, and housing values could drop up to 20% - but just look at the terrible track records - they've been predicting this every year for the last decade, and they've been wrong.